AI Investing Guide | How to Profit from the AI Revolution

Artificial intelligence (AI) is no longer a distant concept—it’s revolutionizing industries and creating unique investment opportunities. But is it a smart move for investors or just another bubble waiting to burst? The key to success is understanding AI’s potential and making informed decisions. This guide will show you how to invest in AI, with practical strategies and tips to help you take action.

Why AI Matters for Investors

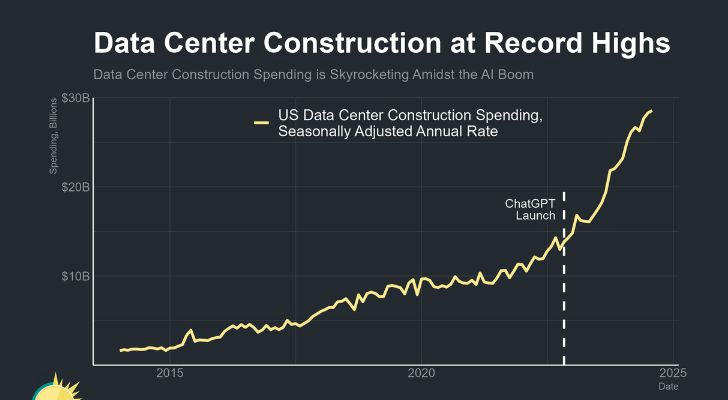

AI is growing rapidly. The AI industry is expected to exceed $1 trillion by 2030, as companies across various sectors, such as healthcare, finance, and retail, adopt AI technologies to boost productivity. This is not just a trend—it’s a technological shift that will reshape the economy for years to come.

Actionable Tip: Start by researching companies that are at the forefront of AI development, such as NVIDIA, Microsoft, and Alphabet. Track their AI-related innovations and financial reports to understand their market position.

AI’s Impact Across Industries

AI’s influence reaches far beyond the tech sector. Here’s how it’s transforming key industries:

Healthcare: AI is improving diagnostics and drug discovery. Example: IBM’s Watson Health is enhancing cancer detection.

Finance: AI-driven algorithms help firms like Goldman Sachs make faster, more accurate investment decisions.

Retail: Companies like Amazon use AI to personalize customer experiences, increasing sales and satisfaction.

Automotive: Tesla and Waymo are advancing self-driving technology, disrupting transportation.

Cybersecurity: Companies like CrowdStrike use AI to enhance digital security.

Actionable Tip: When selecting AI stocks, diversify by investing in companies across different industries to capture the broad potential of AI.

Success Stories in AI Investments

Here are examples of how AI investments have paid off:

NVIDIA’s Growth: In 2023, NVIDIA’s stock rose by over 200% thanks to its leadership in AI chips.

Microsoft and OpenAI: Microsoft’s $10 billion investment in OpenAI boosted its Azure cloud platform, making it a key player in AI computing.

Tesla’s Valuation: Tesla’s AI-driven self-driving technology and robotics division have contributed to its soaring market valuation.

Alphabet’s AI Success: Alphabet continues to integrate AI into its search, advertising, and cloud businesses, driving revenue growth.

Actionable Tip: Use a stock tracker, like Yahoo Finance, to monitor the performance of AI-focused companies and adjust your portfolio as needed.

Effective AI Investment Strategies

To make the most of AI opportunities, here are some practical strategies:

Invest in AI Leaders: Companies like NVIDIA, Microsoft, and Alphabet are established players with proven track records in AI.

- Action: Consider investing in large-cap companies that lead in AI research and development for stable growth.

Diversify Across AI Sectors: Don’t limit yourself to pure AI companies. Look for AI applications in healthcare, finance, and retail.

- Action: Invest in AI ETFs (Exchange-Traded Funds) or mutual funds that provide exposure to AI across various sectors.

Explore Startups with High Potential: Startups in AI can offer substantial returns, though they come with more risk.

- Action: Consider venture capital funds or angel investing groups that focus on promising AI startups.

Stay Informed on AI Regulations: Changes in government policy could affect AI development.

- Action: Follow AI-focused news outlets like TechCrunch or AI Weekly to keep up with regulatory changes.

Invest in AI ETFs: AI-focused ETFs, such as the Global X Robotics & AI ETF (BOTZ), provide diversified exposure to AI companies, reducing individual stock risks.

- Action: If you’re new to AI investing, start with an ETF to spread your risk across multiple companies.

Risks of AI Investing

While AI offers huge opportunities, there are also risks:

Market Volatility: AI stocks can be highly volatile due to rapid technological changes.

Regulatory Risk: Governments could impose regulations that limit AI growth.

Overvaluation: Some AI companies may be overhyped, leading to inflated stock prices.

Ethical Concerns: AI’s impact on privacy, jobs, and bias could spark legal or public challenges.

Actionable Tip: To manage risks, consider setting stop-loss orders to protect your investments from sudden drops and allocate some funds to more stable, dividend-paying stocks.

Where AI Is Heading: Future Trends

AI will continue to evolve, and these trends are worth watching:

Generative AI: Companies like OpenAI are developing AI that can create content, from text to images.

AI-Powered Automation: AI will automate repetitive tasks, disrupting industries like manufacturing and customer service.

Quantum Computing: Companies are exploring how quantum computing can enhance AI capabilities.

AI in Green Energy: AI is being used in climate technology and sustainability, areas that will attract substantial investment.

Actionable Tip: Keep an eye on companies at the cutting edge of these trends. For example, watch stocks in quantum computing, such as IBM, to stay ahead of emerging AI breakthroughs.

Conclusion: Taking the First Step in AI Investing

AI is a revolutionary technology, and its investment potential is vast. By understanding AI’s impact, diversifying your investments, and staying informed, you can take advantage of the opportunities it presents.

Actionable Tip: Start by building a balanced portfolio with a mix of AI leaders, ETFs, and potentially high-growth startups. Gradually increase your exposure as you become more confident in the sector.

"AI is the new electricity. Just as electricity transformed industries 100 years ago, AI will do the same today." – Andrew Ng

Would you like to stay updated on AI investment trends? Keep informed and make smart decisions today!

Thank you for reading! Here’s to a successful investment journey!