Diversification: The Smart Way to Lower Your Investment Risk

A Safety Net for Your Investments

Imagine a trapeze artist. Would they perform without a net? Probably not! Diversification is your safety net in the world of investing. It’s the strategy of spreading your investments around so that if one investment stumbles, your whole portfolio doesn’t come crashing down. But how do you build that safety net effectively?

Don't Put All Your Eggs in One Basket

At its heart, diversification is about minimizing risk. It's acknowledging that no one can predict the future with certainty, and therefore, it's wise to protect yourself from unexpected events.

Key Diversification Strategies with Real-World Examples

1. Asset Class Diversification: Stocks, Bonds, and Beyond

The Strategy: Allocate your money across different asset classes like stocks, bonds, real estate, and even commodities. These assets tend to react differently to economic changes.

Real-World Example:

Scenario: Let's say you have $100,000 to invest.

Aggressive Allocation: A younger investor might put 80% in stocks and 20% in bonds.

Conservative Allocation: An older investor nearing retirement might prefer 40% stocks, 50% bonds, and 10% in cash.

Actionable Tip: Use low-cost Exchange Traded Funds (ETFs) to easily access different asset classes.

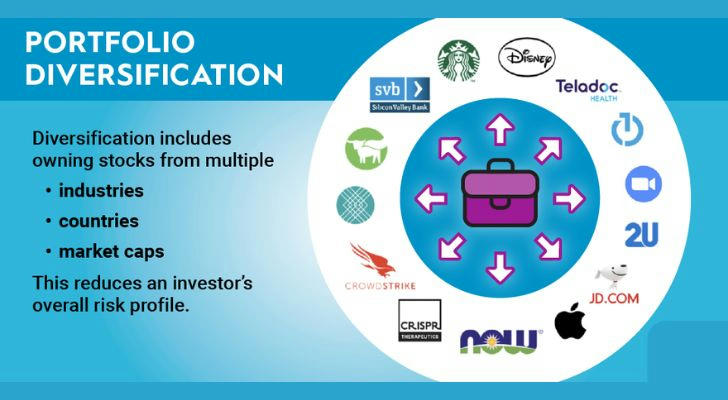

2. Industry Diversification: Beyond the Tech Bubble

The Strategy: Avoid concentrating your investments in a single industry. Different industries have different cycles.

Real-World Example:

The Problem: During the dot-com boom, many investors loaded up on tech stocks. When the bubble burst, their portfolios were decimated.

A Better Approach: Instead of just tech, invest in a mix of industries like healthcare, consumer staples, energy, and financials.

Actionable Tip: Research ETFs that track specific sectors or industries. Look for well-balanced funds that aren't overly concentrated in a few top holdings.

3. Geographic Diversification: Think Global, Act Local

The Strategy: Expand your investments beyond your home country to reduce the risk of being too heavily exposed to a single economy or political environment.

Real-World Example:

The Challenge: An investor solely focused on U.S. stocks might miss out on growth opportunities in emerging markets like India or Southeast Asia.

A Diversified Solution: Allocate a portion of your portfolio to international ETFs or mutual funds that invest in global stocks.

Actionable Tip: Consider a global ETF, which provides exposure to companies around the world.

4. Company Size and Type Diversification: Big Caps, Small Caps, and Everything In Between

The Strategy: Within your stock investments, diversify across companies of different sizes (market capitalization) and growth styles (growth vs. value).

Real-World Example:

The Downside of Focusing on Only Large Companies: While large-cap stocks offer stability, they may not have the same growth potential as smaller companies.

A Balanced Approach: Include a mix of large-cap (blue-chip), mid-cap, and small-cap stocks in your portfolio.

Actionable Tip: Consider ETFs that focus on specific market caps.

Building Your Diversified Portfolio – Step-by-Step

1. Assess Your Risk Tolerance: Are you comfortable with higher volatility for the potential of higher returns, or do you prefer a more conservative approach?

2. Determine Your Asset Allocation: Based on your risk tolerance and time horizon, decide on the percentage of your portfolio to allocate to each asset class (stocks, bonds, real estate, etc.).

3. Choose Your Investments: Select specific ETFs, mutual funds, or individual stocks that align with your asset allocation strategy.

4. Rebalance Regularly: Periodically review your portfolio and rebalance to maintain your desired asset allocation. For example, if your stock allocation has grown too large due to market gains, sell some stocks and buy more bonds to bring your portfolio back into balance.

Examples of Diversification in Action

Scenario 1: Market Downturn: The stock market experiences a sudden decline. Because you're diversified across asset classes, your bond holdings help to cushion the blow.

Scenario 2: Industry Collapse: A major scandal rocks the tech industry. Your portfolio is protected because you're not overly concentrated in tech stocks.

Scenario 3: International Crisis: A political crisis in one country causes its stock market to crash. Your global diversification helps to limit the impact on your overall portfolio.

(Important Caveats: Diversification Isn't a Magic Bullet)

Diversification is a risk management tool, not a guarantee against losses.

It's possible to over-diversify, which can dilute your returns.

You need to rebalance from time to time to adjust to market changes

Conclusion: Your Financial Safety Net

Diversification is a smart and effective way to reduce risk and increase your chances of achieving your long-term financial goals. By spreading your investments across different asset classes, industries, regions, and company sizes, you can build a portfolio that’s resilient to market volatility and positioned for long-term success. It might not make you a millionaire overnight, but it will help you sleep better at night knowing that your investments are protected.