Tech Stocks vs. Traditional Stocks | Which Should You Choose?

The world of investing offers countless opportunities, but one of the biggest decisions investors face is whether to invest in tech stocks or traditional stocks. Tech stocks promise rapid growth and innovation but come with volatility. Traditional stocks, on the other hand, offer stability and long-term returns but may not see explosive gains. With market trends shifting constantly, how do you decide which is the right fit for your portfolio? This article compares tech and traditional stocks, highlights real-life success stories, and provides actionable steps to help you make an informed investment decision.

What Are Tech Stocks?

Tech stocks represent companies that operate in sectors like software, artificial intelligence, cloud computing, e-commerce, and biotechnology. These businesses tend to experience rapid growth due to technological advancements and changing consumer behaviors. However, tech stocks are also more volatile, as their success depends on innovation, competition, and regulatory challenges.

Case Study: NVIDIA’s AI Boom

NVIDIA, a leader in AI-driven computing, saw its stock price skyrocket by over 200% in 2023, fueled by the increasing demand for AI-powered chips. Investors who recognized the AI trend early benefited tremendously. However, NVIDIA’s stock has also faced periods of sharp decline due to supply chain issues and market corrections. This highlights both the potential and risks of investing in tech stocks.

Case Study: Tesla’s Volatility

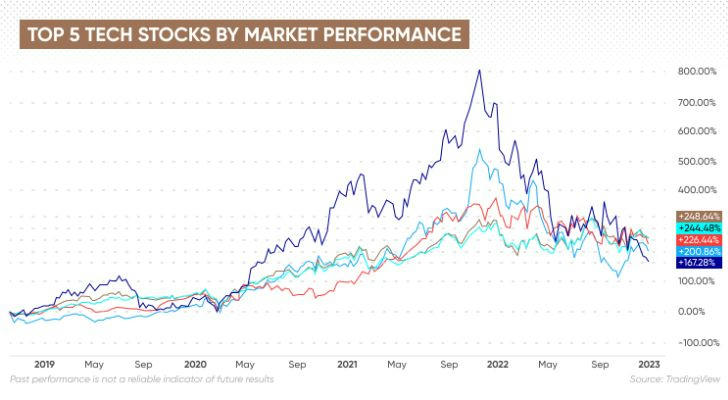

Tesla, the electric vehicle giant, exemplifies both the upside and downside of tech investing. The company’s stock soared more than 1,000% between 2019 and 2021 due to strong demand for EVs and breakthroughs in self-driving technology. However, in 2022 and 2023, Tesla faced major stock declines as supply chain disruptions, interest rate hikes, and CEO Elon Musk’s controversial decisions impacted investor confidence. Despite these fluctuations, long-term Tesla investors have still seen significant gains.

The Appeal of Traditional Stocks

Traditional stocks represent companies in well-established industries like consumer goods, utilities, finance, and healthcare. These businesses have proven track records, steady earnings, and often pay dividends, making them appealing for long-term investors who prioritize stability over rapid growth.

Case Study: Procter & Gamble’s Steady Growth

Procter & Gamble (P&G), a consumer goods giant, has delivered consistent returns for decades. Despite market downturns, the company’s broad product range and global reach keep its revenue stable. While P&G won’t see the massive growth rates of a tech company, its reliability makes it a valuable portfolio addition. Investors benefit from steady dividend payments, making it an excellent choice for those looking to generate passive income.

Case Study: Johnson & Johnson’s Resilience

Johnson & Johnson (J&J), a leader in healthcare, has proven to be one of the most stable stocks in the market. The company has increased its dividend for over 60 consecutive years, even during recessions. During the COVID-19 pandemic, J&J not only maintained financial stability but also played a key role in vaccine development, further solidifying its reputation as a defensive investment.

Growth Potential vs. Stability: A Direct Comparison

Tech Stocks: High Growth, High Volatility

Tech companies thrive on innovation, and those that disrupt industries can achieve exponential growth. However, the risks are substantial—companies that fail to innovate or face regulatory scrutiny may suffer steep declines.

Example: Meta (Facebook) saw its stock decline significantly in 2022 due to challenges in the metaverse sector and concerns over data privacy regulations.

Example: Amazon’s stock surged during the pandemic but later faced a correction due to economic slowdowns and shifts in consumer spending.

Traditional Stocks: Stability and Dividends

Companies in sectors like food, energy, and finance tend to have steady earnings and reward investors with dividends. Their growth might not be explosive, but they provide security during economic downturns.

Example: Warren Buffett’s Berkshire Hathaway holds large investments in traditional companies like Coca-Cola and American Express, emphasizing long-term stability.

Example: Energy companies like ExxonMobil may not have high growth potential, but they generate strong cash flows, making them reliable dividend-paying stocks.

How to Choose: Key Investment Strategies

Your choice between tech stocks and traditional stocks depends on your financial goals and risk tolerance. Below are actionable steps to guide your investment decisions.

1. Assess Your Risk Tolerance

If you’re comfortable with high risk and want aggressive growth, allocate more to tech stocks.

If you prefer stability, focus on traditional stocks with a track record of steady returns.

2. Diversify Your Portfolio

A well-balanced portfolio should include a mix of both tech and traditional stocks.

Consider a 60% traditional stocks and 40% tech stocks approach for a balance of growth and stability.

ETFs like Vanguard Information Technology ETF (VGT) provide diversified tech exposure, while Dividend Aristocrat ETFs focus on traditional stocks with reliable dividend payouts.

3. Time Your Investments Wisely

Tech stocks are best bought during market pullbacks when prices are lower.

Traditional stocks provide consistent value and can be bought for long-term holding.

Look for opportunities to invest in undervalued companies that have strong fundamentals.

4. Monitor Market Trends

Keep an eye on emerging technologies like AI, blockchain, and quantum computing.

Watch economic indicators like interest rates, inflation, and corporate earnings reports to determine the right timing for investing in traditional stocks.

5. Rebalance Your Portfolio Regularly

Market conditions change, and your portfolio should adapt.

If tech stocks have surged and now make up too much of your portfolio, consider reallocating some profits into traditional stocks.

If the economy is facing uncertainty, shifting towards defensive stocks (like healthcare and utilities) may provide stability.

Actionable Investment Examples

Tesla: If you’re willing to take on higher risk for potential higher returns, consider investing in Tesla during periods of market dips. Stay informed about the company’s technological advancements and production capacity.

NVIDIA: Given the ongoing AI boom, NVIDIA remains a strong investment choice, especially for those betting on future AI developments.

Coca-Cola: If you prefer stability, Coca-Cola offers consistent dividends and is a great long-term holding.

Johnson & Johnson: A reliable healthcare stock that has demonstrated resilience during recessions and economic downturns.

Conclusion: Finding the Right Balance

Choosing between tech and traditional stocks ultimately depends on your financial goals, risk tolerance, and market outlook. If you seek rapid growth and can handle volatility, tech stocks may be your best bet. If you value stability and dividends, traditional stocks offer a safer path.

The best strategy is often a combination of both, allowing you to benefit from innovation while maintaining financial security. By diversifying, staying informed about market trends, and adjusting your investments over time, you can create a portfolio that balances risk and reward effectively.

In today’s ever-changing investment landscape, making smart, well-informed decisions is key to long-term financial success. Whether you invest in tech giants, steady blue-chip stocks, or a mix of both, having a strategic plan will help you navigate the stock market with confidence.

Thank you for reading! I wish you a smooth life and work!