The Economic Engine: How Social Security Drives Consumer Spending and Fuels Growth

Social security is a cornerstone of the American economy, providing essential financial support to millions of citizens, particularly the elderly. As the population ages and the number of retirees continues to grow, understanding the impact of social security on consumer spending and overall economic growth becomes increasingly important. This article explores how social security acts as an economic engine, its effects on consumer behavior, and the implications for future economic sustainability.

The Vital Role of Social Security in Consumer Spending

Social security provides crucial benefits to retirees, disabled individuals, and survivors of deceased workers. Funded primarily through payroll taxes from current workers and their employers, social security serves as a financial lifeline for many Americans. In 2025, approximately 67 million people receive social security benefits, which constitute a significant portion of their income. For many elderly recipients, these benefits are their primary source of income, underscoring the program's importance in maintaining financial stability.

Social Security as a Stabilizer

Social security plays a critical role in reducing poverty among older adults. According to the Social Security Administration (SSA), without these benefits, nearly half of older Americans would fall below the poverty line. By providing a steady income stream, social security helps beneficiaries maintain their purchasing power, which is vital for consumer spending.

Impact on Disposable Income

The monthly benefits received from social security directly contribute to disposable income levels. For instance, an average monthly benefit of around $1,600 enables retirees to cover essential living expenses such as housing, food, and healthcare. When beneficiaries spend this money on goods and services, they stimulate demand in the economy, supporting local businesses and creating jobs.

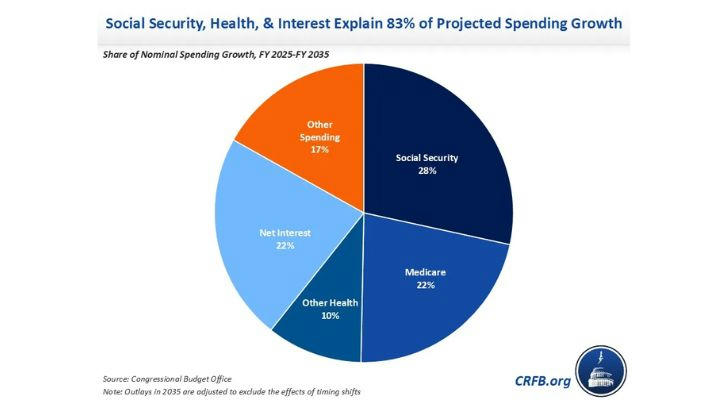

Social Security Spending: A Catalyst for Economic Growth

Increased consumer spending driven by social security benefits has direct implications for economic growth. When elderly individuals spend their benefits on everyday necessities, they contribute significantly to overall demand in the economy.

Direct Effects on Economic Growth

Research shows that every dollar spent from social security generates additional economic activity. For example, a study by the National Bureau of Economic Research found that social security payments lead to increased consumer spending in sectors such as healthcare and retail. This heightened demand can result in business expansion and job creation.

The Multiplier Effect

The concept of the multiplier effect illustrates how initial spending can lead to further economic activity. When social security beneficiaries spend their benefits at local businesses, those businesses experience increased revenue. This revenue may then be reinvested into hiring more employees or expanding operations, thereby further stimulating economic growth. For instance, when an elderly couple purchases groceries or pays for healthcare services using their social security benefits, they not only support those businesses but also contribute to job retention and creation within their communities.

Challenges Facing Social Security and Its Impact on Growth

Despite its positive contributions to consumer spending and economic growth, social security faces significant challenges that could affect its sustainability.

Funding Shortfalls

The Social Security Trust Fund is projected to deplete its reserves by 2033 if no reforms are enacted. This impending shortfall raises concerns about future benefit reductions for millions of Americans. If benefits are cut or fail to keep pace with inflation, consumer spending could decline significantly, leading to slower economic growth.

Public Perception and Political Challenges

Public attitudes toward social security are mixed. Many Americans express concern about its long-term viability and advocate for reforms to ensure its sustainability. Political debates surrounding potential changes can create uncertainty among beneficiaries, affecting their spending behavior. For example, if seniors fear that their benefits will be reduced due to political gridlock or reform proposals, they may cut back on discretionary spending.

Policy Recommendations for Strengthening Social Security

To enhance the positive impact of social security on consumer spending and economic growth, several actionable policy recommendations can be considered:

Enhancing Social Security Benefits: Increasing benefit amounts can help better reflect living costs and improve the financial stability of retirees. Adjusting benefits based on an elderly-specific inflation index could ensure that seniors maintain their purchasing power over time.

Diversifying Funding Sources: Exploring alternative funding mechanisms for social security could help alleviate pressure on the Trust Fund. Potential solutions include increasing payroll tax rates or implementing new taxes on high-income earners.

Promoting Financial Literacy: Providing educational resources for beneficiaries about managing their finances effectively can help maximize their economic impact. Workshops or online courses focused on budgeting and investment strategies could empower seniors to make informed decisions with their benefits.

Investing in Community Programs: Supporting local initiatives that promote healthy aging can also enhance the effectiveness of social security spending. For instance, community centers offering health services or recreational activities can improve seniors' quality of life while encouraging them to spend locally.

Implementing Gradual Reforms: Policymakers could consider gradual reforms that increase retirement age or adjust benefit calculations over time rather than making abrupt changes that could destabilize beneficiaries' financial planning.

Conclusion

Social security serves as an essential economic engine that supports consumer spending and drives growth in the United States. By providing a reliable source of income for millions of Americans, it plays a critical role in maintaining financial stability for retirees and vulnerable populations alike. However, addressing the challenges facing social security is crucial to ensuring its sustainability and continued contribution to the economy.

As policymakers consider reforms to strengthen this vital program, it is imperative to recognize its importance not only as a safety net but also as a catalyst for economic growth. By enhancing benefits and exploring sustainable funding options while promoting financial literacy among beneficiaries, we can secure a brighter financial future for all Americans while fostering a robust economy that thrives on consumer spending.