What is pension investment?

Pension investment refers to a way of accumulating funds for retirement. By regularly saving money and investing it, pension plans help people have enough income to maintain their living standards when they retire. This investment is usually long-term and involves a variety of assets such as stocks and bonds to achieve capital appreciation and ensure future financial security.

Where is the long-term nature of pension investment reflected?

The long-term nature of pension investment is evident in several ways. First, it takes decades to accumulate sufficient funds for retirement living expenses. Second, long-term investments help withstand market fluctuations, allowing focus on overall fund growth rather than short-term volatility. Additionally, the compound interest effect enhances asset appreciation over time. Finally, diversifying investments across different asset types, like stocks and bonds, reduces risks and ensures steady growth of your pension. Together, these factors contribute to a better quality of life in retirement.

What is diversified investment?

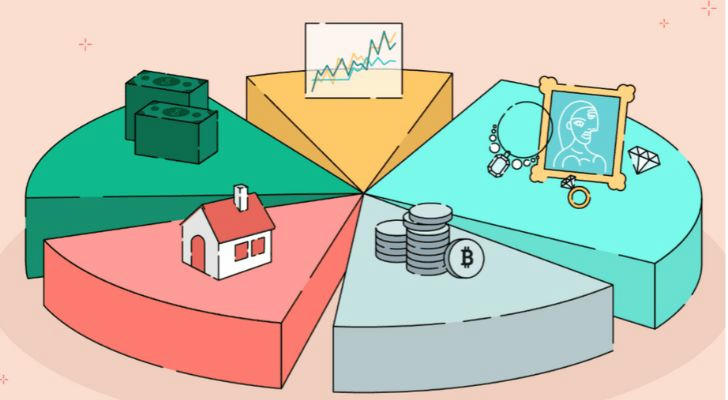

Diversification is the process of spreading your money across different types of assets to reduce risk. Specifically, it manifests itself in the following ways:

Different asset classes: For example, investors can allocate their money across multiple assets such as stocks, bonds, and real estate. If stocks perform poorly, bonds or real estate may remain stable, thus protecting overall returns.

Industry diversification: Investors can choose companies from different industries, such as technology, healthcare, and consumer goods. In this way, even if one industry encounters volatility, the performance of other industries may make up for the losses.

Geographic diversity: Investing in different countries or regions can reduce losses caused by geopolitical or economic fluctuations. For example, investing in stocks in the United States and Japan may allow the Japanese market to perform well when the US economy is in a downturn.

Time span: Investing in different time periods can avoid the impact of short-term market fluctuations. For example, regular fixed-amount investments can spread the risk brought by market fluctuations.

Through these diversification strategies, investors are able to better manage risks and achieve more stable returns.

How to manage risk?

Pension investment risk management includes the following steps: identifying risks (such as market fluctuations, economic changes, etc.), assessing risks (analyzing the probability of occurrence and impact), and formulating countermeasures, such as asset diversification (diversifying investments in stocks, bonds, real estate, etc.), setting stop-loss points (limiting losses), and purchasing insurance (transferring some risks). At the same time, it is necessary to continuously monitor the investment portfolio and market dynamics and adjust strategies in a timely manner. For example, the Norwegian Global Pension Fund effectively controls risks through stress testing. These measures ensure the safety of pension funds and achieve long-term stable appreciation.

Examples of managing risk

Successful cases of pension investment risk management include: the Canadian Pension Plan (CPP) controls risk by adjusting the asset portfolio ratio (e.g., adjusting the stock-bond ratio from 65/35 to 85/15); the Norwegian Government Pension Fund Global (GPFG) adopts passive investment strategies and stress testing to strictly manage investment risks; the Japanese Government Pension Investment Fund (GPIF) reduces the risks brought by market fluctuations through diversified asset allocation and stress testing; and the New Zealand Superannuation Fund (NZSF) achieves sustainable returns by dynamically adjusting asset allocation and adopting ESG standards. These strategies effectively ensure the long-term and stable appreciation of pension funds.

The selectivity of pension investment

Investors can choose different pension products according to their risk preferences and needs. For example, individuals can choose low-risk savings products such as treasury bonds and pension savings, or choose high-risk and high-yield funds and stocks. For example, the pension target fund launched by ICBC Credit Suisse Fund allows investors to choose the appropriate risk level according to retirement time, simplifying investment decisions.

Flexibility in pension investment

The way to receive pensions is also flexible. Investors can choose to receive pensions monthly, in installments or in one lump sum, so that they can adjust the source of income according to their personal financial situation. For example, some people may need a stable monthly income after retirement, while others may want to receive it in one lump sum to cope with large expenses.

What are the pension financial products?

Pension savings: low-risk savings accounts of banks.

Pension financial products: invest in bonds and stocks, and pursue stable returns.

Commercial pension insurance: such as annuity insurance, providing retirement income security.

Pension target funds: investment funds designed specifically for pensions, diversifying investments.

Trust products: long-term investments managed by trust companies.

Personal pension investment management advice

Personal pension investment advice includes:

First, understand different product types, such as savings, government bonds and pension funds, and choose appropriate investments based on risk preferences. Second, take advantage of tax incentives and deposit funds in time to enjoy policy advantages. Third, diversify assets and spread funds into stocks, bonds and real estate to reduce risks. Monitor the investment portfolio regularly and adjust strategies in time to cope with market changes. Finally, consult professional advisors for personalized advice if necessary. These measures will help individuals effectively manage pensions and achieve better retirement life security.

Pension investment is an important guarantee to ensure retirement life, with long-term and flexibility. Through diversified investment and effective risk management, investors can reduce risks and increase returns. At the same time, the global pension market is facing trends such as population aging and policy changes, which promote product innovation and service upgrades. Various pension financial products, such as pension savings, financial products and commercial pension insurance, meet different needs. Choosing the right pension product will help everyone achieve a more secure retirement life.